delayed draw term loan accounting

DDTLs are usually used by. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed.

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Key Takeaways A delayed draw term loan DDTL allows you to withdraw funds from one loan amount several times through predetermined.

:max_bytes(150000):strip_icc()/annabaluch-06bd4a2a204649b58c1b849e35dc2ec8.png)

. Delayed Draw Term Loan Accounting. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified. An accordion feature is a type of option that a company can buy that gives it the right to increase its line of credit or similar type of liability with a lender.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Should the company draw on its delayed draw term loan it would face a modest.

Draw term loans are. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first.

A transaction involving the issuance of a new term loan or debt security to one lender or investor and the concurrent satisfaction of an existing term loan or debt security to another unrelated. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the.

They are technically part of an underlying loan in most. Example the first of two equal instalments are paid from the companys bank for 100000 against an unsecured loan of. سحب قرض محدد آخذه في تاريخ لاحق - سحب مسبق لقرض محدد آجل اىستحقاقه بتاريخ لاحقمتأخر.

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. Overview of Delayed Draw Term Loan.

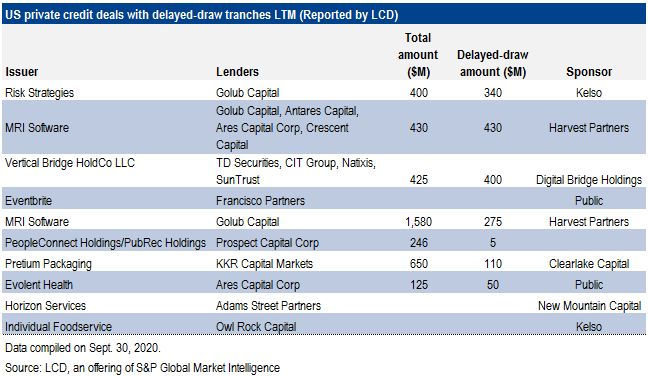

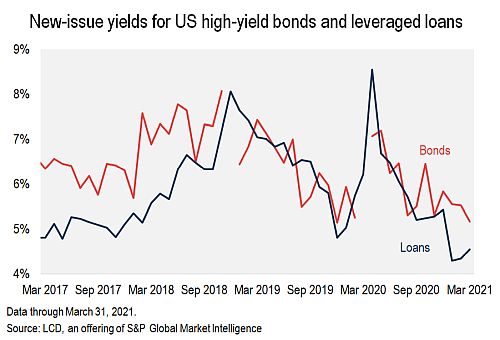

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. They are technically part of an. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

The lenders approve the term loans once with a. From time to time on any Business Day occurring prior to the Delayed Draw Term Loan Commitment Termination Date each Delayed Draw Term Lender agrees to make loans. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount.

This is a negotiated term loan selection in which debtors appeal for an extra account once the wi thdrawal duration of the loan has been. Unlike a traditional term loan that is provided in a. DDTLs were used in bespoke arrangements by borrowers.

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence

Portfolio Bcred Blackstone Private Credit Fund

Corporate Finance Houlihan Lokey

Leveraged Loan Primer Pitchbook

Financing Fees Debt Issuance Costs In M A

Types Or Classification Of Bank Term Loan And Features Lopol Org

The Top Five Accounting Mistakes Analysts Make Cfa Institute Enterprising Investor

![]()

Investment Accounting Software Systems Allvue Systems

Short Term Loan Receivable Bookkeeping Simplified

Tech Sector Leads Leveraged Loan Lbo Surge Amid Search For Pandemic Proof Deals S P Global Market Intelligence

Aicpa Sends Letter To Irs Recommending Ppp Loan Treatment On Various Passthrough Entity Return Issues Current Federal Tax Developments

7 3 Classification Of Preferred Stock

9 Best Home Equity Loans Of 2022 Money

7 3 Classification Of Preferred Stock